In his latest Coffee Break Briefing webinar, Frettens’ own Insolvency Guru Malcolm Niekirk looked at mortgages, charges and debentures.

This is the summary of that briefing.

If you'd like to watch the webinar back, you can do so below, If not, read on for our summary...

Quick Links

Here are some quick links to help you navigate this long and comprehensive article quicker...

- The types of charges

- Debentures

- Why do we need to categorise charges?

- How do mortgages work?

- How do floating charges work?

- Registering at Companies House

The types of charges

There are two main reasons why charges matter, the first is about the priority of charges.

As a general rule, secured creditors rank ahead of unsecured creditors and secured creditors do not rank equally between themselves.

The second reason for categorising charges, is that secured creditors have rights that unsecured creditors do not have.

These rights are:

- Property rights

- Contractual rights

- Statutory rights

- Equitable (legal) rights

What are the types of charges?

There are many ways to categorise charges, including (but not limited to):

- Unilateral-notice charges

- Unregistered charges

- Fixed charges

- Floating charges

- Equitable charges

- Written charges

- Un-written charges

What aren’t charges

There are many things that look like charges but are not. For example…

A pledge – essentially pawn broking.

This is where the owner of the items being pledged, physically hands over possession from the lender to the pawn brokers so, the person giving security under the pledge no longer has possession of it.

Retention of Title & Conditional Sale

Under these arrangements, the person selling the goods – (or other property) continues to own complete title of it until they have been paid in full. Meanwhile, the buyer does not have any interest in the goods, as the title is entirely held by the seller.

Related article: How does a retention of title clause work?

Hire purchase/leasing/hire arrangements

Where ownership remains with the person providing the credit, the person in possession does not own the goods (or other property).

Invoice discounting & factoring

Where debts are assigned and bought by the financier.

What is a charge?

Where the property owner, (the debtor), grants a security interest over their property, to someone else to whom they owe a financial obligation (the creditor).

The debtor will remain the owner and remain in possession of the property. The creditor gains a right over the proceeds of sale. This is limited to the financial obligation.

Is a charge different from a mortgage?

A mortgage has two meanings:

- A bank would call a big loan to buy your home a “mortgage”.

- Lawyers call a type of charge, which is commonly used to secure that big loan a mortgage.

A mortgage is a type of charge. Some charges are mortgages. All mortgages are charges. But not all charges are mortgages.

Typically, a creditor with a mortgage has better rights.

What is an equitable charge?

A charge is either legal or equitable. No charge can be both.

As a generalisation, a legal charge will rank ahead of an equitable charge.

- Equitable charges are easier to set up.

- Some charges can only be equitable charges (e.g. a floating charge).

What is a registered charge?

Charges can be registered in different registries. Many charges need to be registered in at least two registers. For example:

- Companies House – all charges created by companies must be registered here

- The Financial Conduct Authority (FCA) is a similar registry (if the borrower is a mutual society)

- The High Court (bills of sale registry)

- Agricultural Credits Department (in the Land Charges Department of the Land Registry)

Those are the compulsory registers. Charges are void if they should be registered there and are not. The consequences of non-registration are therefore very serious.

These are the voluntary registers:

- The Land Registry – deals with most of the land in England and Wales

- The Land Charges Department (for the rest of the land in England and Wales)

- The Ship Register

- The Civil Aviation Authority (Aircraft Registration Section)

- The Intellectual Property Office (for patents, registered TMs and registered designs)

Charges that are not registered (but could be registered, in a voluntary register) will still be valid. But it won’t carry the priority it should until it is registered.

At the Land Registry, there are several different ways of registering a charge depending on the type of charge (such as if legal or equitable, and the priority of that charge).

Do charges have to be in writing?

No, but some do.

An unwritten charge can only ever be an equitable charge, not a legal charge.

- Even a charge created by a handshake, has to be registered at Companies House (if the borrower is a company).

- Any charges on land have to be in writing and signed (both by the lender and the borrower).

- A bill of sale must be in writing, and in the statutory form. (Charges on goods or debts are “bills of sale”, if creating by an individual or partnership).

What’s the difference between a fixed and a floating charge?

Generally, floating charges rank after fixed charges.

A fixed charge blocks the borrower, (the owner of assets), from dealing with those assets, unless the lender releases them from the charge.

A floating charge does not have this block. The owner can deal with them in the normal course of their business, without needing permission from the lender.

Floating charges are normally over a class of assets (rather than specific, identified items) – but so too can be a fixed charge.

Upon ‘crystallisation’, a floating charge becomes a fixed charge. Then the borrower needs permission from the lender to deal with the charged property.

What is a debenture?

There are two meanings:

- In corporate finance, a debenture is a written document which acknowledges debt (this can be secured or unsecured).

- In insolvency, a debenture is a document that creates a battery of charges which charge almost everything, (sometimes literally everything) that the borrower company owns.

An insolvency debenture usually includes many ‘fixed’ charges too, (some of which may really be floating charges).

It also usually includes a ‘qualifying floating charge’ which empowers the lender to appoint an administrator under Paragraph 14 of Schedule B1.

Some (very rare) debentures empower the lender to appoint an administrative receiver.

Why do we need to categorise charges?

There are two reasons, as:

Validity

Some charges need particular formalities to be valid, such as registration at Companies House, or to be in a written, signed document. A charge on land is an example of this.

Priority

Charges almost never rank equally amongst themselves.

- Legal charges rank over equitable

- Older charges rank over newer

- Registered charges rank over unregistered (in priority registers)

- Fixed charges rank over floating charges

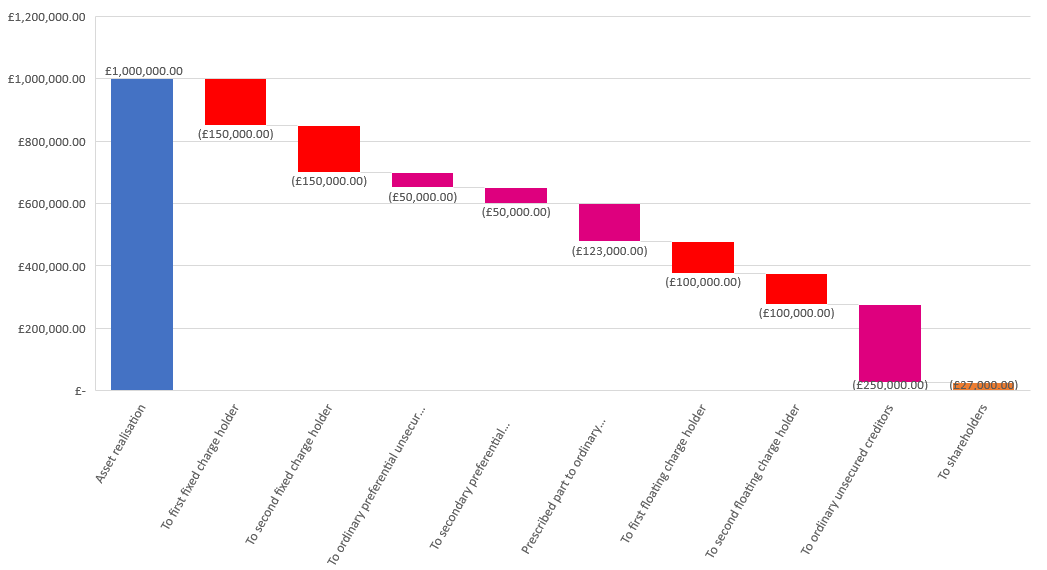

Here’s a waterfall diagram which demonstrates how priority works – we’ll assume that each of the classes of creditor is repaid in full:

- We start off with £1,000,000 of asset realisations, probably a single asset, probably a freehold property.

- Then we’ve got the first and second fixed charge holders being paid in full with £100,000

- After that, the ordinary and secondary preferential creditors are paid in full with £50,000

- The prescribed part then goes to the ordinary creditors (as a percentage of the remaining part)

- After which, the first and second floating charge holders are paid £100,000 in full.

- The ordinary unsecured creditors receive £250,000

- The shareholders end up with £27,000 at the end of the queue

How do mortgages work?

Historically, mortgages of land used to give absolute legal ownership of the property (legal title) to the lender. The borrower had the right to have the land re-conveyed to them, on full repayment of the loan.

Nowadays, mortgages do not work like this, but mortgages of other types of property can still.

A modern legal mortgage of land is normally a charge by legal mortgage. That leaves the borrower as the legal owner of the property and confers important rights on the lender, including:

- Power of sale

- Right to possession

- Power to appoint receivers

In addition to the statutory rights, there are often additional rights which are given by the terms of the mortgage itself.

Do lenders own the property?

Although the lender’s interest looks very similar to ownership of the property, it is limited financially to the debt that they are owed.

The borrower cannot sell the land while there is a mortgage or charge registered at the Land Registry, unless the lender agrees to release their security.

The buyer will always insist on this, as otherwise they risk taking over the buyer’s mortgage and taking on their debt.

Charges on other assets are similar in giving the lender a power of sale and control of the asset.

How do floating charges work?

There are three types of floating charge:

Qualifying floating charge

This is a comprehensive charge where the lender has security over pretty much everything that the company owns.

It also gives the lender the statutory right to appoint an administrator.

Supplementary floating charge

This is an additional floating charge that may be ‘tucked away’ in a mortgage document.

This adds to the lender’s main security and gives them a little more control than they’d otherwise have.

Lightweight floating charge

A type of qualifying floating charge but in a very short succinct document.

Here the lender never intends to appoint an administrator but wants the right to advance notice if the borrower intends to appoint.

Floating charges can be created by corporations (including companies), but not individuals or partnerships (unless they’re farmers).

More on floating charges

Floating charges normally catch a class of assets, for example:

- ‘All present and future stock-in-trade’

- ‘All the assets, property and undertaking of the company’

Floating charges allow the borrower to deal with the property that is caught by the charge without needing any further consent from the lender. This lasts until the charge ‘crystallises’ and becomes a fixed charge.

Crystallisation of a floating charge does not change its priority. A crystallised floating charge can protect a company’s assets from executing creditors.

Administrators have a statutory right to deal with property caught be a crystallised floating charge. They do not need to ask the bank (or other charge holder) for permission to sell the assets.

Appointment formalities

Before a lender can appoint a receiver (or an administrator), the charge must become enforceable. To make the charge enforceable, the lender has to:

- Check that they’ve got the right to call in the loan and make a formal demand

- Make a formal demand for repayment, in writing

- Allow the opportunity to pay the debt (even when they know that the borrower can’t and won’t pay the debt. This must be a minimum of one hour, whilst the banks are open

- Now the charge is enforceable, and a valid appointment can be made

Registration at Companies House

Companies that create security have to register charges within 21 days at Companies House.

There are similar rules for other entities which are as follows:

- Mutual societies, whose registry is the FCA, have to register charges there.

- Charitable incorporated organisations don’t have to register their charges.

- Individuals and partnerships charging chattels (or debts) have to register the charges at the High Court (Bills of Sale Registry).

What if a charge is not registered at Companies House within 21 days?

If a charge is not registered within 21 days, it is void. Effectively, the lender is unsecured.

Companies House has no discretion to accept late registration. If the charge is delivered on day 22, it will not be registered without a court order.

Getting a court order for late registration is problematical. The court order will normally instruct the lender to share their security with all other pre-existing creditors. This means they will not be the only party entitled to that security

Some lenders who’ve missed the registration window ask their borrower to sign another charge and register it with a later date on it. This is risky as that charge could be set aside:

- Under s245 IA’86 (during its first 12 or 24 months, if the charge is a floating charge); and

- Under s239 IA’86 (as a preference during its first six or 24 months).

(In both of these cases, the shorter period normally applies, but is replaced by the longer period if it is not an arm’s length transaction).

Upcoming Events

Our first annual insolvency conference will be on Friday 10th June.

Details have been sent out to email list subscribers, so make sure to check your inbox if you haven’t already! If you're not subscribed to our list, you can sign up here for free, and find booking details here.

Insolvency & Restructuring Solicitors near London, in Hampshire & Dorset, near Southampton and in Bournemouth, Poole, Christchurch and The New Forest

We hope you found the briefing useful. If you are an insolvency practitioner who would like to discuss the content of this article further, please do not hesitate to get in touch

Comments