In his latest Coffee Break Briefing webinar, Frettens’ own Insolvency Guru Malcolm Niekirk looked at MVLs and indemnities to shareholders.

As always, the briefing was directed towards appointment taking insolvency practitioners and those working with them.

This is the summary of that briefing.

If you'd like to watch the webinar back, you can do so below, if not, read on for our summary...

Quick Links

Here are some quick links to help you navigate this long and comprehensive article quicker...

- Why do we use indemnities?

- The formal statutory procedure for distributions

- The normal ‘shortcut’

- What if there were no indemnity?

- Different forms of indemnity

- An indemnity checklist

- Practical points – when indemnities get complicated

- A summary of the points discussed

Why we use indemnities

An indemnity allows the liquidator to make an early distribution. This way, soon after appointment, the shareholders get most of the money that is due to them.

If it weren’t for the indemnity, the liquidator would be likely to follow the statutory procedure; which would mean:

- Advertising for claims for creditors

- Waiting for those claims to come in

- Further time to process them and pay them

As liquidator, even when there is an indemnity and you make an immediate early distribution, you would normally hold on to enough money to pay known claims, to cover your fees and expenses, and for a contingency.

The formal statutory procedure for distributions

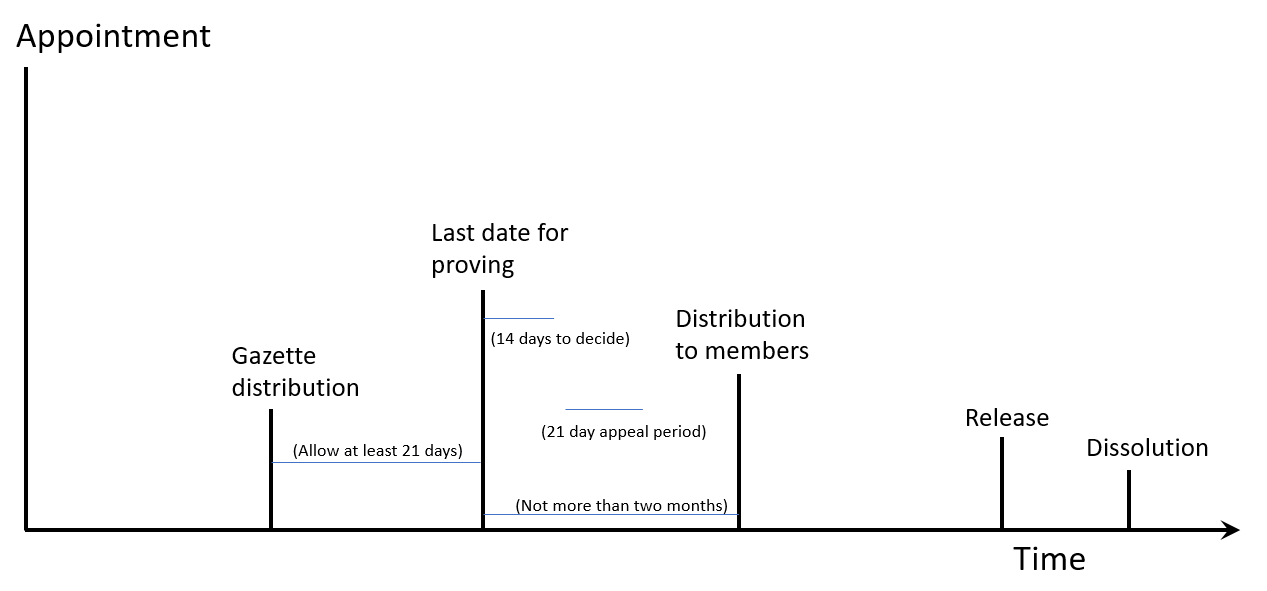

The 2016 Insolvency Rules recognise that MVLs are a distinct procedure (with CVL’s and compulsory liquidations also being separate procedures).

Part 14 of the Insolvency Rules contains the general rules applicable to all insolvency procedures for creditors to prove their claims and for the office holder to distribute payments. MVLs are no different.

Before paying a final (or only) distribution to creditors, you should:

- Gazette a notice to creditors:

- Giving at least 21 days to prove the claim

- Giving a distribution date (within two months after the last proving date)

- Telling them you won’t pay them if they haven’t proved

- Also send it to all creditors who have not proved

- And, you can also advertise by other means if you think it useful

Once the date for creditors to deliver their proofs has passed, you then have 14 days to:

- Admit or reject them (in whole or part); or

- Make provision for them

You have no duty to deal with proofs that are delivered late, but have a discretion to accept them.

What does this mean for you?

In summary, what this means is, you:

- Advertise for claims

- Wait 21 days

- Pay within two months

- Wait for the 21 day appeal period to pass

- Provide, if there is a difficult claim, or postpone if very difficult

Once you’ve done this, your duty is done. If a late claim comes in, the company is not released from its obligation to pay. Although the company is at risk from a late claim, you are not. The creditor could seek a winding up order (among other options).

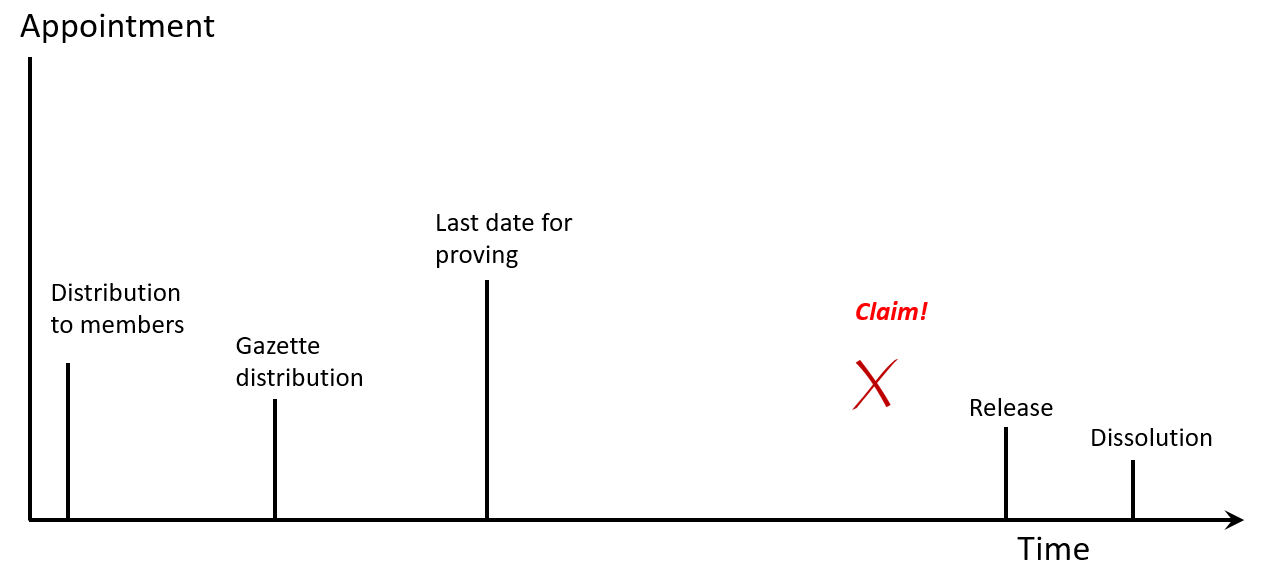

A diagram of the process

This shows a MVL distribution ‘by the book’

The normal ‘shortcut’

Here’s the procedure followed by most liquidators…

- Appoint as soon as the declaration of solvency is sworn

- Add a deed of indemnity to the documents tabled for signing

- Get the company’s funds into your client account

- Hold back enough to pay the liquidation expenses, creditors and a sensible contingency

- Pay the rest to the shareholders

- Gazette for creditors so that you gain statutory protection

- Close liquidation

What if there were no indemnity?

In a case where you’re doing it ‘by the book’ you may choose not to take an indemnity (relying instead on statutory protection).

What if an unexpected claim comes in on time?

- You must admit the claim (assuming it’s valid)

- And pay it – if the company has funds

- Or convert the MVL into a CVL if the company can’t pay it

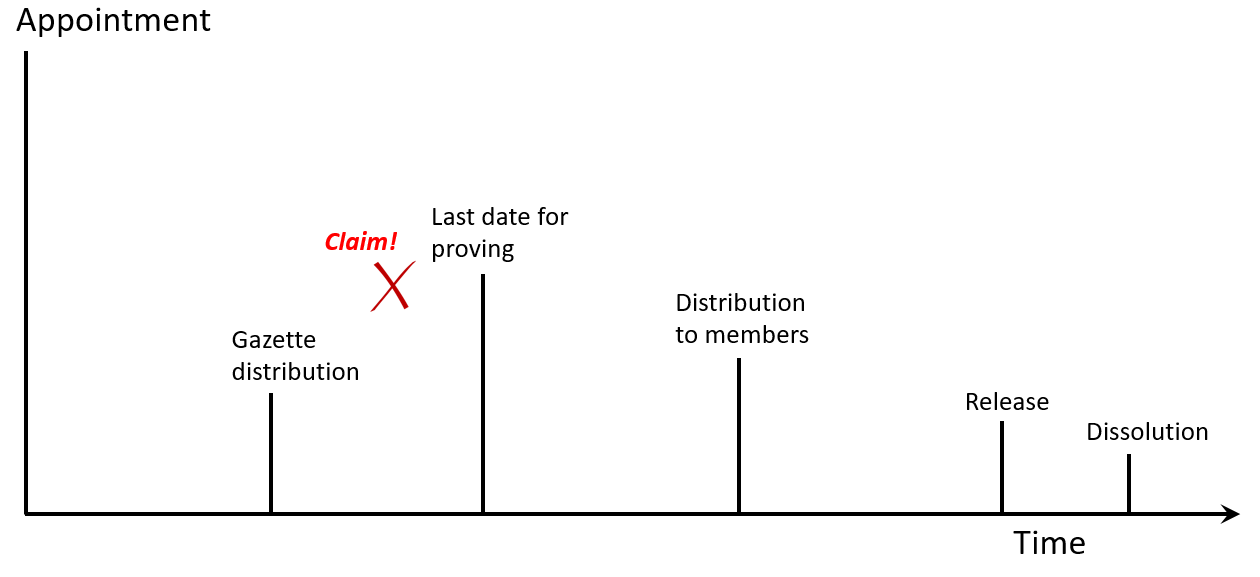

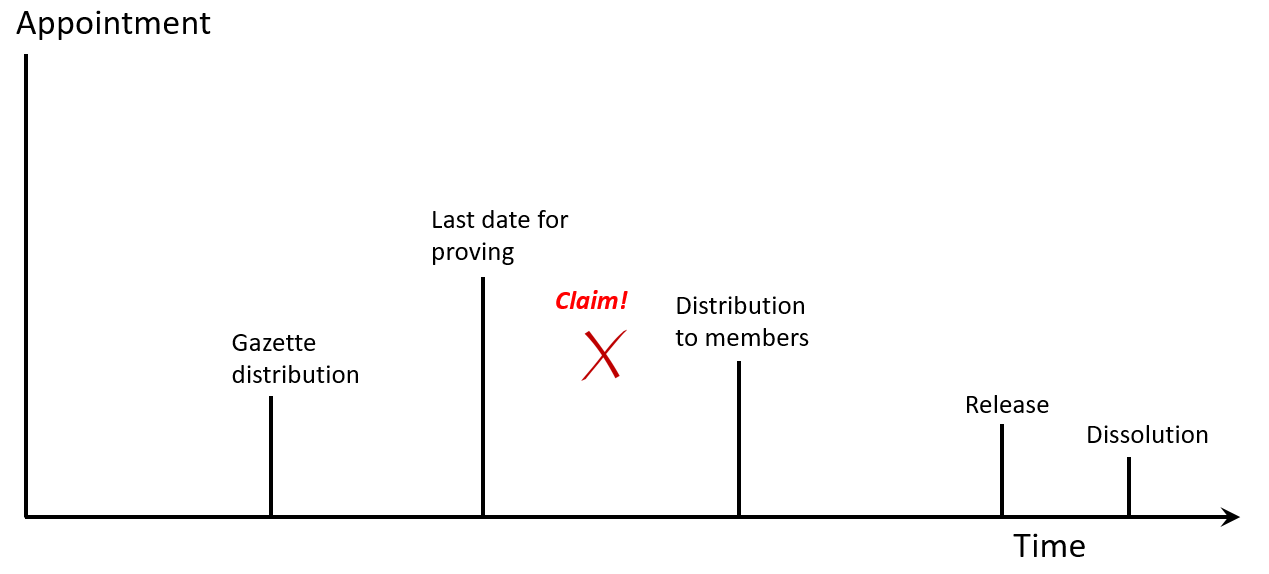

Claims after the last date for proving

Suppose a claim comes in late (after the last date for proving). You then have a discretion to accept it. You probably will accept it, if you’ve not then distributed the company’s funds to its members.

You may have to convert the MVL to a CVL.

Suppose you decide not to admit it (and in this example the liquidator has not distributed to the shareholders), then the company still owes the debt. The creditor may present a winding up petition or seek a freezing order, to stop the shareholders receiving their distribution.

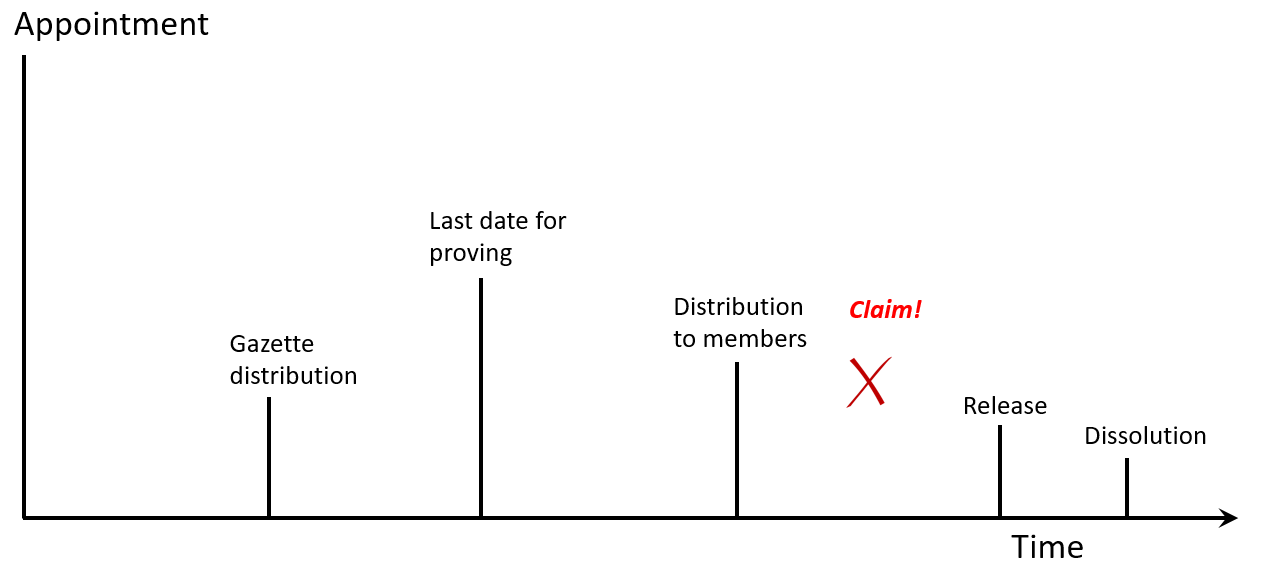

Claims after fund distribution

Here, the same applies as above. You may admit the claim, or not.

If you don’t pay (and in this example the liquidator has distributed to the shareholders, so may be unable to pay):

- The company still owes the debt

- The creditor may present a winding up petition

- Compulsory liquidator may investigate the distribution as an antecedent transaction

- But you should not be at risk of claims against you for misfeasance – you, the voluntary liquidator - did your duty. So the lack of an indemnity does not put you at risk.

Doing it quickly – not by the book – and without an indemnity

In this particular case, I’m suggesting that the liquidator has been prudent. Although they’ve made an early distribution, they’ve also gazetted that distribution.

They’ve not followed the timetable, but they’ve set a last date for proving; after which a claim has come in.

In a case like this – it wouldn’t be misfeasance, as you would have done your duty and the claim was outside the last date for proving.

However, as before, the creditor would be able to bring legal action against the company for non-payment and put it into compulsory liquidation quite probably.

In the presentation, I shipped over a number of slides that showed examples of other situations. Please do drop me an email if you would like copies of those slides.

What are the different forms of indemnity?

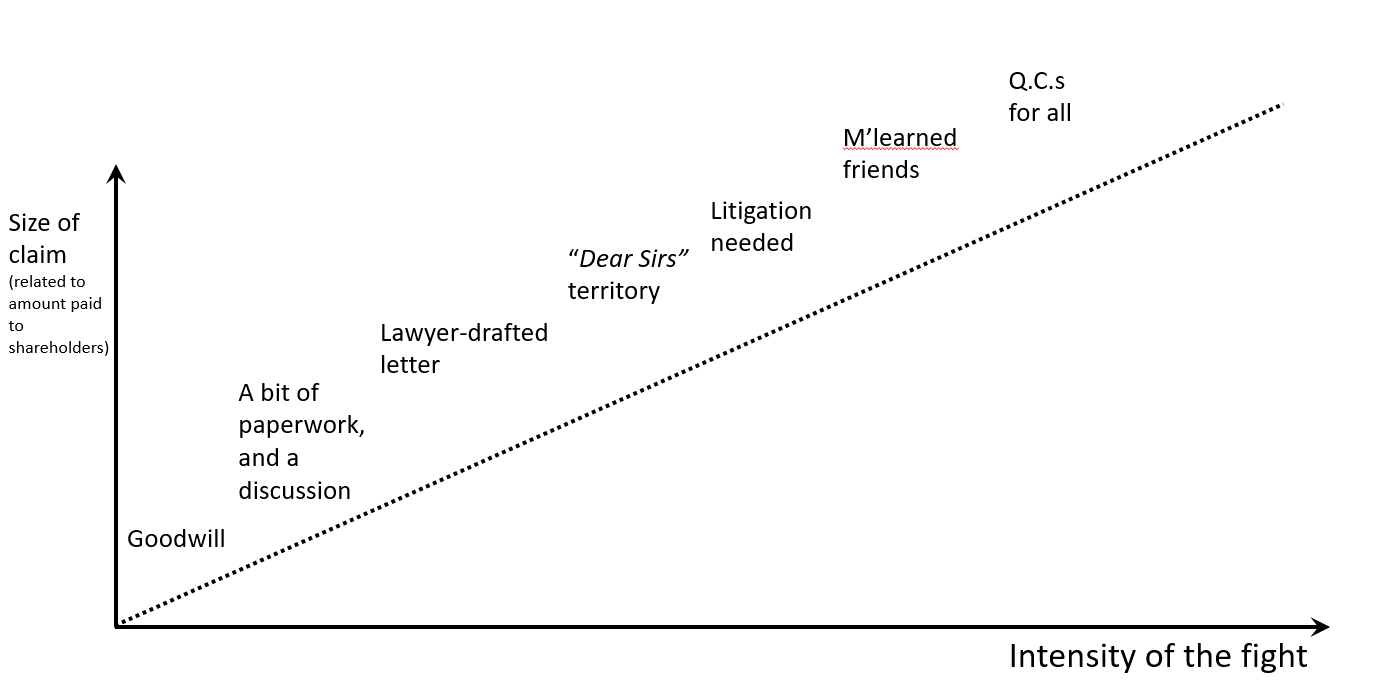

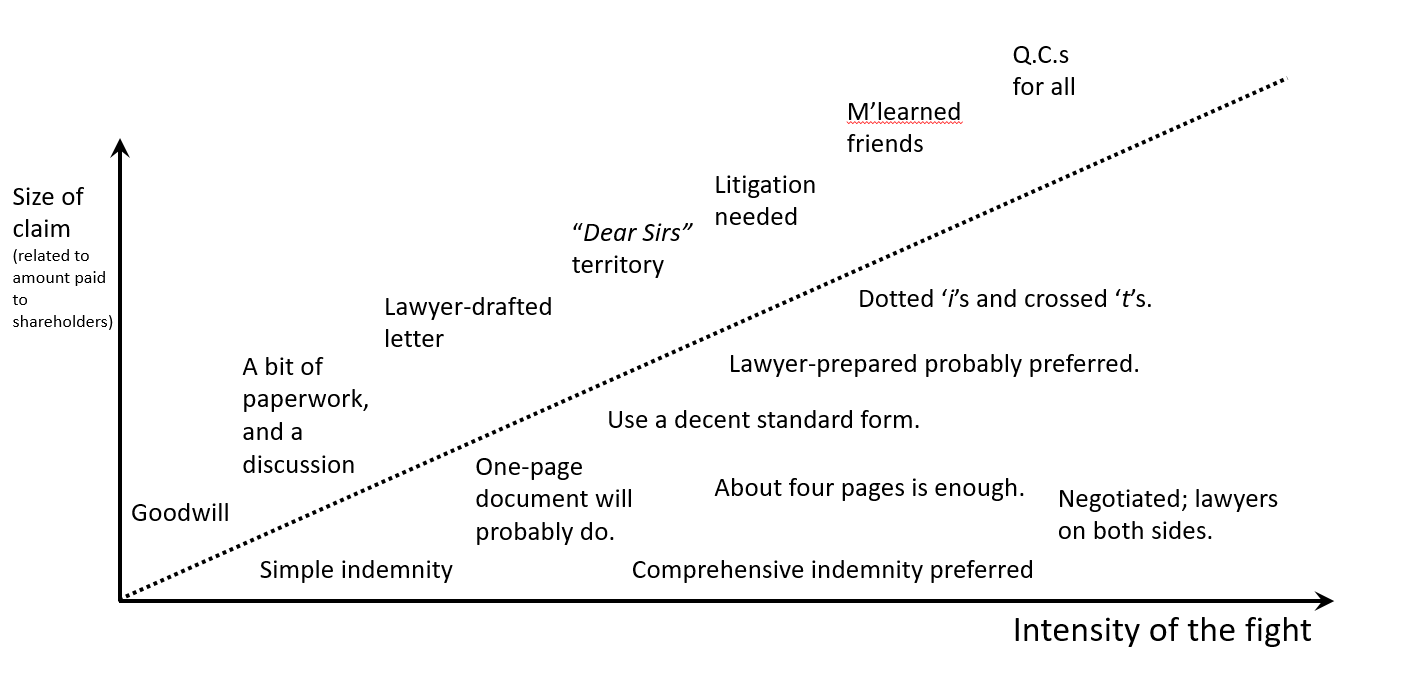

Broadly speaking, the more that is stake – the more difficult, complicated and expensive it will be to sort out disputes.

At the bottom end of the scale, small claims may be sorted out with no more than a phone call or email to set out your reasons (possibly a lawyer to draft a letter to do it).

At the other end of the scale, proceedings may be needed, it could turn into a contested case, and it could well require senior barristers on both sides.

How do you protect yourself?

Many, perhaps most MVL’s don’t have enough at stake for claims to be likely to get very contentious. Pragmatically, a short, simple, one-page indemnity is probably good enough for many of the smaller ones.

For most of the more sophisticated cases, you can probably cover yourself adequately with a standard four-page document. Four pages is enough. Some liquidators use indemnity forms that have ‘evolved’ (sometimes with ‘dangerous mutations’) over time and have become over complicated.

An indemnity checklist

The minimum

- Company name and number?

- All shareholders correctly identified?

- Indemnity to the company?

- Indemnity to the liquidators?

- Joint and several liability (to the extent that’s appropriate)?

The four-page indemnity

This includes the above, but adds:

- Indemnity to the liquidators, to include their successors in office?

- Indemnity to the practice (and its people)?

- Wide and effective description of ‘claims’?

- Exclusion of negligence?

- Warranties from the shareholders?

- Duration of the indemnity?

- Appropriate boilerplate?

- Executed as a deed?

Practical points – when indemnities get complicated

Overseas shareholders

There are broadly three problems that can arise from overseas shareholders; foreign law, foreign courts and assets overseas.

Foreign law

- For example, in France, a personal guarantee must be refreshed regularly.

- Normally, if an English or Welsh company, we’d set our law for the indemnity.

Foreign courts

- Normally, if an English or Welsh company, we’d give our courts jurisdiction.

- But you may need to serve papers overseas.

- And you may need to get a local judgement registered in the foreign court for enforcement.

Assets overseas

- Foreign laws may make enforcement overseas difficult (e.g. US states with ‘homestead’ protections).

- Can you find the assets; do you speak the language?

Non-aligned shareholder groups

Normally the indemnifiers have joint and several obligations. This works if it’s a family company with few shareholders.

But, suppose the shareholders are unrelated, then you may find that they’re not willing to be jointly and separately liable.

A complex liability sharing arrangements may be required with provisions for picking up any shortfall.

Shareholders who are trustees

They won’t be the beneficial owners of the shares and so will likely want to limit their personal liability.

Perhaps to the lower of payments received by them, and funds in their control when you make a claim. This may, or may not, be acceptable to you.

Corporate shareholders

You’d have to look at:

- The value of their covenant

- The other assets that they have

- The plans for them

The indemnity from them may not have much value if they distribute their assets to their own shareholders.

Distribution in specie

Consider:

- How you value the asset

- It may be worth much more – or less – when you need to call on the indemnity.

- How the shareholders’ liability is capped

- Is the wording clear enough on the figure for the cap?

- The shareholders’ plans for the asset

Negotiating indemnities

- Many indemnities ask for an indemnity against defective appointments.

- Many indemnities ask for cover from almost all liabilities – but not those incurred through negligence.

- This is often a point of negotiation with the shareholders.

- Perhaps include a warranty from the shareholders:

- On the accuracy of the declaration of solvency;

- On the validity of the formal resolutions?

Related: What is professional negligence and how to prove it

Lots of shareholders

Lend the money to them instead. Follow up later, when ready, with either a distribution in specie of the loans; or a cash distribution of the full amount (setting off the loans).

In other tricky cases, this may be a viable alternative to an indemnity.

The disadvantage is that the shareholders are unlikely to have joint and several liability.

A summary

Here’s a summary of the point discussed today, and the key takeaways…

- Indemnities should be addressed to the company, as well as to the liquidator

- Short (one page) indemnities may be best for small MVLs

- More detailed (four pages) indemnities may be needed for larger MVL’s (you decide which ones)

- Make sure your indemnities are not over-complicated

- Ask a lawyer to review the largest, and most complex cases, for example:

- Over the £ threshold you set.

- For a distribution in specie.

- If there are non-aligned shareholders.

- If you’re asked to change the wording of the indemnity.

- If there’s more than one related MVL.

- Expect lawyers to negotiate the most complex cases

- Make sure your letter of engagement allows you to re-charge the costs of lawyers’ negotiations

- Consider distributing ‘by the book’ (so you don’t need an indemnity) in cases where:

- The shareholders are (or will be) overseas.

- The shareholders are trustees

- There are corporate shareholders

- There are many shareholders

- Consider also – in some cases – making an interim loan to shareholders, pending final distribution.

- Document the loan as you would an indemnity.

- Use forms with good ergonomics:

- The more you have to type into them (before they are signed), the greater the chance for a mistake.

- You should need to enter only names, addresses and company numbers into an indemnity. And, in each case, only once.

- Keep a master, blank template (‘Blue Peter’ document production has its place; but not here).

Downloads

A copy of the full presentation can be downloaded here.

Some dates for your diary

- Frettens’ Second Annual Insolvency Conference – June 2023

- SESCA conference (Reading University) – 8-9 September

- SESCA insolvency seminar (Denbies Wine Estate) – 6 October

- NTI TAP online presentation (bankruptcy remuneration) – late August

- R3 SPG forum (Birmingham) – 3-4 November

- R3 Southern & Thames Valley forum (Reading) – March 2023

Thank you for reading this summary. You can watch back our previous briefings and read back previous summaries here.

To keep informed on upcoming Coffee Break Briefings, events and insolvency news you can sign up to our email list for free here.

Specialist Insolvency Solicitors

We hope you found the briefing useful. If you are an insolvency practitioner who would like to discuss the content of this article further, or instruct us, please do not hesitate to get in touch.

Comments