In his latest Coffee Break Briefing webinar, Frettens’ own Insolvency Guru Malcolm Niekirk looked at post appointment supplies and what he thinks about the new statutory moratorium extension to protect the delivery of them.

This is the summary of that briefing.

If you'd like to watch the webinar back, you can do so below, if not, read on for our summary...

Quick Links

- The ring-fence moratorium

- What’s new from Section 233B?

- The rights that are affected

- How suppliers are affected

- What can suppliers do post-appointment?

- How does this affect insolvency practitioners?

The ring-fence moratorium

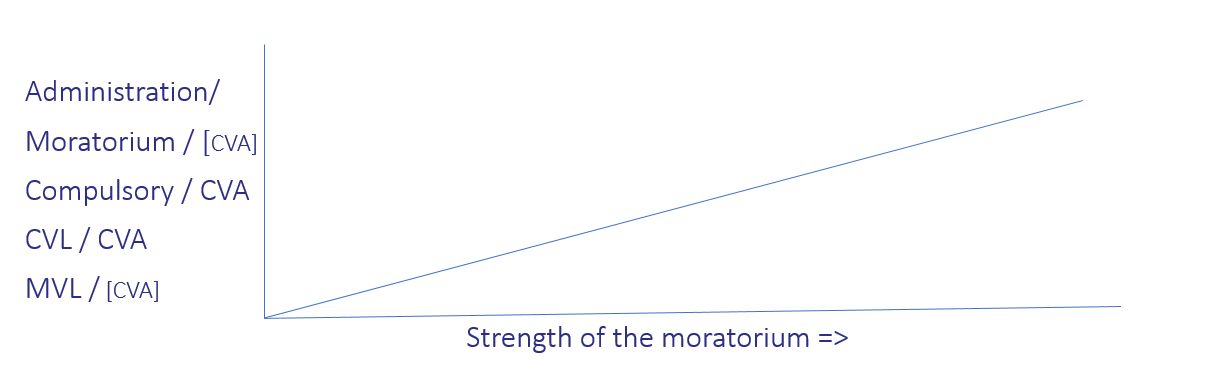

The insolvency ring-fence moratorium is common amongst procedures. All statutory insolvency procedures give a degree of protection against creditors, some stronger than others.

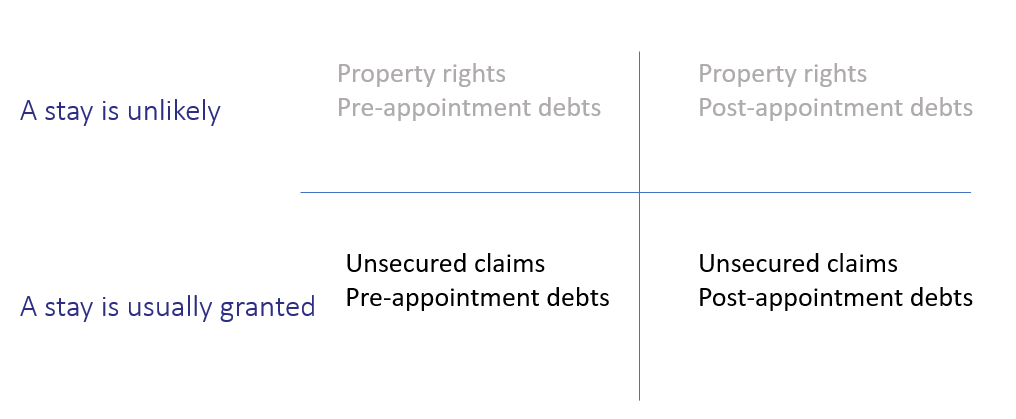

The moratorium often works differently for property rights as against the rights of unsecured creditors. Property rights are generally better protected.

This recent extension to the moratorium squeezes in between unsecured claims and property rights. It deals with the rights that suppliers have, to stop supplying to an insolvent company.

This new aspect to the moratorium is as its most effective immediately after your appointment. It protects the insolvent business against those looking to terminate supplies as soon as the insolvency starts, based on pre-appointment events.

What’s new from Section 233B?

There is a new switch which turns off the rights that suppliers would otherwise have to suspend supplies and stop deliveries to a business going through an insolvency procedure.

This is not so much about one off deliveries. This is more about contracts for a series of supplies or continual supplies. For example:

- Utilities

- Internet

- Raw materials or finished products

- Accountancy services

- Franchised rights

Supplier contracts & rights

Suppliers’ contractual rights will be effectively neutered. Supplier contracts would normally contain:

- An end date

- (Automatic) renewal terms

- Obligations on the supplier

- What; when; how much, etc

- Obligations on the customer (our BustCo)

- Payment terms

- A right to end the contract (or suspend supplies)

- On notice

- On breach

Termination Clauses

Termination clauses usually have two parts to them. ‘Events of default’, a list of actions that, if they were to occur, would lead to termination and a list of ‘Consequences’.

The ‘consequences’ outline what rights the supplier has in the event of default. Usually one of these would be the right to suspend or stop deliveries.

Events of default:

- Late payment

- [Other breaches of terms]

- Formal insolvency (the start of a statutory procedure)

- [Technical insolvency] (inability to pay debts when due, or an insolvent balance sheet).

Consequences:

- Formal notice [and request to put right]

- [Time to put right]

- [Suspension of deliveries]

- Termination of the contract

Ipso Facto Clauses

The ‘events of default’ that give suppliers the right to terminate on the fact of insolvency alone are known as ipso facto clauses.

These clauses are affected by s233B and are thus switched off upon the appointment of an insolvency practitioner. This extension to the insolvency moratorium has been introduced primarily to prevent suppliers effectively holding insolvent businesses to ransom.

The rights that are affected

There are five provisions in Insolvency Act 1986 that affect ispo facto clauses:

- s233 – has a limited effect, only affected the rights of ‘essential suppliers’

- s233A – has a wider effect, only applies in CVAs and Administrations

- s233B – has an even wider effect, applies to almost all insolvency procedures and to most suppliers

The other two provisions, s372 and s372A only apply to personal insolvency procedures but have a similar effect to s233-233A.

How suppliers are affected

Suppliers may have the contractual right to stop delivering because of the insolvency or because of other breaches. That contractual right is compromised by these provisions.

Not only does the legislation stop the supplier from suspending deliveries, but also from using commercial pressure to try and gain an advantage over unsecured creditors.

There are three categories of supplier covered by the new legislation:

Essential Suppliers

Utilities (Gas, Water, Electricity), Telecoms (Mobile, Broadband), IT (Hardware, Software, IT Support etc).

Essential suppliers are covered by:

- s272 (≈s233) – for bankruptcy & interim receivership (but only trading cases)

- s233 & s233A (or s372 & s372A) – for Administration, CVA and (but trading cases only) IVA

- s233 & s233B – for most other corporate procedures (not Pt 26 CA’06)

- None of the above – for Pt 26 schemes and arrangements; non-trading bankruptcy and IVA

Exempt Suppliers

The moratorium on enforcing ipso facto clauses does not affect these suppliers. One category is financial services (where either the supplier or bust company is an insurer, bank, electronic money institution etc).

The other category is where the contract is for: financing, securities, commodities, swaps etc.

Exempt suppliers are not restricted in how they use ipso facto clauses and don’t have different rules for different insolvency procedures.

All other suppliers

These are suppliers that are neither essential nor exempt. They’ll be restricted either by s233B only (for some corporate insolvency procedures), or nothing (for all personal insolvency procedures).

Administrations & CVAs

In the case of administrations & CVAs, the way that you deal with the supplier will depend on whether they are an essential supplier or another supplier.

If they’re an essential supplier, they can ask for a personal guarantee from you as administrator or supervisor. If you don’t sign that guarantee within 14 days, they have the right to stop supplies.

They can also:

- Terminate if they supply and there are more than 28 days of post-appointment arrears

- Ask the court to allow termination (to avoid supplier hardship)

- Ask the insolvency practitioner to permit termination

For other supplies, creditors again can ask the court or the IP to permit termination. The moratorium does not protect the administration/CVA from the consequences of post-appointment breaches of contract.

Liquidations and other corporate procedures

Liquidations are similar but the moratorium is better because essential and non-essential suppliers are treated the same. They have the right to ask for a personal guarantee, but there’s no statutory sanction if it’s not given.

What can suppliers do post-appointment?

Suppose the arrears build?

If you’ve asked them to keep supplying, payment is likely to have priority, as an expense. None of the statutory blocks will stop them pulling the contract for post-appointment arrears, assuming the original contract allows that.

Suppose they have a contractual right to give notice?

If that arises post-appointment, they can use it.

Suppose they have a contractual right to raise prices?

They can do that, but when s233 or s233B applies, they can’t use that as a way of recovering their pre-appointment debt.

Suppose they see the insolvency coming?

They may be able to terminate, for technical insolvency, before you’re appointed. But, their ipso facto clause must include technical insolvency as a trigger; many of them do. If they can terminate, they can renegotiate.

How does this affect insolvency practitioners?

For the vast majority of insolvency cases, its not going to be hugely important. Insolvency practitioners, for many years, have been negotiating with suppliers to ensure essential supplies continue despite their appointment.

Cases where it might be important, will be cases where:

- The business is trading to complete contracts and collect debtors.

- The business is trading to seek a going concern sale.

- The business is closed, but supplies need to continue, to preserve assets:

- Data on the servers

- Cloud data

- Fish in the freezers

A day one issue?

Quite possibly, continuity of supplies is a day one issue for you.

You should:

- Look at the statutory protection that you’ve got, make sure you understand how its going to work for the suppliers you’re going to be negotiating with,

- Check the funding you have available, particularly where personal guarantees are involved,

- Contact the suppliers early so they understand from the outset that their rights have been restricted,

- Be prepared to offer guarantees where essential – make sure they include a notice clause (to allow you to withdraw your guarantee).

This may affect your choice of procedure

Potentially. So, for example, I’m not a huge fan of the new moratorium procedure or restructuring plans; but they do offer better protection from suppliers than do administrations and CVAs.

In addition, moratoria may give less notice to suppliers too so there’s less risk of pre-appointment terminations.

Liquidations offer better protection from suppliers than administrations do. In appropriate cases, you might want to consider a Centrebinding court order to extend your rights, instead of administration, for business sales.

As a general rule, in the past, suppliers have often been willing to keep the supply flowing, on the basis that they will be paid for it, as a priority. But now it’s harder for them to hike their prices as part of the deal.

Upcoming events

Thanks for reading this summary…

Our Third Annual all-day in-person Insolvency Conference will be taking place in 2024. Date and venue to be confirmed. Make sure you’re subscribed to our email list to receive event information straight to your inbox.

My next Coffee Break Briefing will be on 9th October, where I’ll be looking at Berkeley Applegate orders (how to deal with third party funds, such as a client account, held by the insolvent).

Again, more information will be available via the email list.

Specialist Insolvency Solicitors

If you have any questions after reading this article, please don’t hesitate to get in touch with our bright and experienced team.

Call us on 01202 499255, or fill out the form at the top of this page, for a free initial chat.

Comments