On Monday 8th November, Malcolm Niekirk held one of his popular Coffee Break Briefing Webinars.

In the webinar, Malcolm looked at pre-appointment liquidation sales as an alternative to administration pre-packs.

This is the summary from the presentation. If you’d like to watch it back, you can do so below. If not, read on for a summary.

Quick Links

Please find below some quick links so you can find what you want quickly:

- A bit of Insolvency History

- The options for going concerns

- The Twilight Zone

- Issues for directors

- Issues for the advising IP

- Commercial issues

A bit of insolvency history

Prior to the Insolvency Act 1986, there were two main statutory procedures:

- Liquidations

- A Companies Act procedure

- ‘In-person’ meetings of creditors

- Receiverships

- Largely unregulated

- Informal procedures were not statutory

- Wholly unregulated, and only for the brave

Issues prior to the Insolvency Act

Before the Insolvency Act if a receivership was not possible, it would have to be a liquidation.

The issue for the liquidator was whether to sell the assets before they were appointed (pre-appointment) or following appointment.

Post appointment sales:

- Notice of impending creditor’s meeting likely to damage the struggling business

- The creditors might appoint a different liquidator. This might have resulted in:

- Delayed sale

- Different strategy being required

Pre-appointment sales:

These were often preferred as they were easier for the liquidator, as they wouldn’t have to deal with the business assets themselves.

They would simply take possession of the bank account with the sale proceeds in it.

Liquidators had to take careful control over the directors in the pre-appointment phase.

The Insolvency Act 1986

The new procedures:

- Administration orders

- Administration receivership

- Liquidations

- Voluntary Arrangements

Administrations

In the early days of administrations there was uncertainty about administrators’ power to sell pre-proposal.

Another issue was that administration orders were a very court intensive process.

(And if a pre-pack sale was proposed – the pre-pack sale would come under close judicial scrutiny pre-appointment.)

The costs limited the procedure’s success.

Enterprise Act 2002

This followed the unsuccessful ‘schedule A1’ CVA Moratorium (Insolvency Act 2000)

The Enterprise Act brought ‘schedule B1’ into the Insolvency Act. It allowed for administrations without the need of a court order.

An unanticipated consequence of the Enterprise Act was the rise of administration pre-packs.

The pre-pack sale didn’t need to be as fully developed at the time of appointment as it would’ve been if the IP were going for an administration order.

This led to a lack of creditor oversight and involvement:

- There would be 8 weeks from sale to publication of proposals

- It was difficult for creditors to appoint a different IP

- Various regulatory initiatives eventually led to the ‘pre-pack pool’

This pre-pack pool has now been put on a statutory footing with the phoenix pre-pack regulations. You can read about these regulations here.

The options for going concerns

The two main options, if the company has a good chance of survival, are:

- Voluntary Arrangement

or

- A Part 26A reconstruction (probably only appropriate to the more complex and larger cases)

If the company is unlikely to survive, but the business can, then the options are:

- Trading the business in administration to sell it (viable in few cases)

- Pre-pack administration sale

- Liquidation sale

- Sell, then liquidate; or

- Liquidate, then sell

Potential issues

The potential issues are as follows:

Funding

Considerations:

- Can the business keep trading until the appointment?

- Whether there will be post-appointment trading?

- Even if trading is cash positive, there may be peaks and troughs in cash flow which need funding

Confidence

The business will need the continuing confidence of:

- Suppliers

- Customers

- Employees

Disruption

Your appointment and the sale of the business will each disrupt it. If both happen together, there will be a single shock. If there is a gap between them, the business will have to weather a double shock.

These factors could well disrupt:

- Trading

- The sale

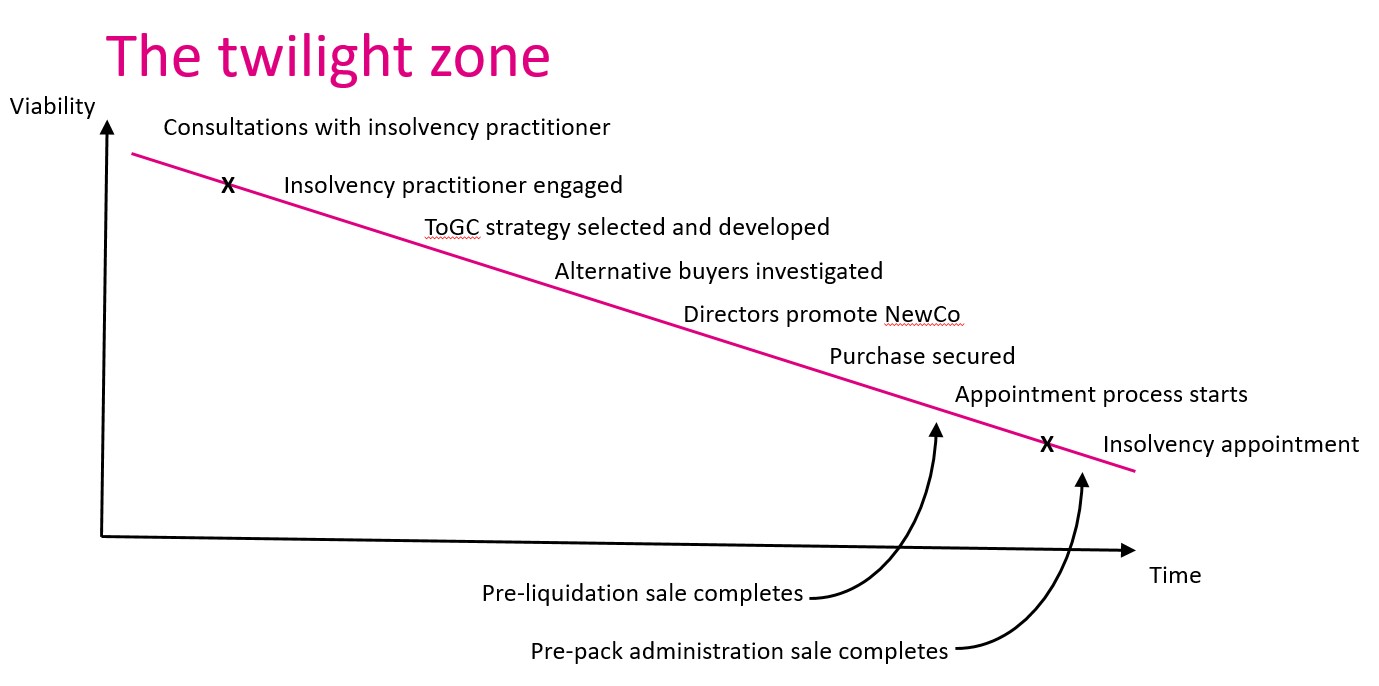

The Twilight Zone

This is the period when the viability of the business is failing. For our purposes, we’ll treat this as being the point at which you sign your engagement letter:

The appointment process is likely to take longer for a CVL than an administration.

So, a pre-liquidation sale and an administration pre-pack might both complete at a similar time.

A sale by a liquidator may take longer (an administration also can take longer where there is a qualifying floating charge [QFC] and thus the need to give notice to a debenture holder).

Issues for directors

Looking at the perspective of the director…

There is no regulator of company directors, so there will be no imposed ethical issues over and above the legal issues.

The main legal issues, are these:

- Companies Act duties

- Insolvency Act (& CDDA) risks

- s216 compliance

Company Act Duties

Duties to shareholders

Even when insolvency is inevitable, the directors do still owe duties to the shareholders.

In particular, if there is to be a substantial disposal of assets to a connected party, that needs shareholder approval in both companies to make sure that it is a valid, binding transaction.

Duties to the board

At this stage, these largely amount simply to board minutes where the connected party transactions are formally disclosed and approved.

Duties to the creditors

These are the main statutory duties directors owe to the company (whose interests are assumed to be those of the creditors at this stage):

- Directors must promote the success of the company

- Directors must show independent judgement

- Directors must use reasonable care, skill and diligence

Those are analogous to the IA’86 duties

Insolvency Act Duties

Directors must not:

- Make commitments that the company will not be able to honour (fraudulent trading)

- Let the debt to creditors to increase (wrongful trading)

- Pay some creditors, but not others (preferences)

- Fail to get fair value for assets (undervalue transactions)

s216 compliance

The new company cannot use the bust company’s trading name for five years. Liquidation, not administration, is the trigger of this (assuming common directors)

Exemptions to s216

The main exemptions are these:

- Notice to creditors in the Gazette (only applicable where the business is sold by a liquidator or office holder)

- Court order (and temporary exemption pending court decision)

- Pre-existing established use

As the first exemption cannot be used safely in pre-liquidation sales, that leaves the directors with these options. Either:

- The new company does not use the same trading name; or

- The new company applies to court for permission to use it.

You can read our dedicated s216 article here.

A summary of the issues for the director

Formal Companies Act compliance by:

- Board minutes

- Shareholder resolutions

Insolvency Act requirements encourage the directors to:

- Appoint an IP at the earliest opportunity

- Document the exit plan

- Monitor and record progress and decisions against the plan

s216 requires:

- A name change for the business; or

- A court order

The issues for you as the advising practitioner

Job security issues

The r6.14 procedure is designed to let creditors choose a liquidator. The issues around this are:

- Statement of affairs – has to be published to the creditors

- List of creditors – has to be published to the creditors

- ‘Hijackers’ get extra time – if they trigger a traditional meeting from the r4.16 notice

- Meeting of creditors

Ethical issues

Consider:

- The self-review threat

- The advocacy threat

- Conflicts of interest

- The prior relationship

- Mitigation

If you’re selling as an administrator…

You have to report on the sale and justify it to the creditors. This is perhaps easier if an evaluator is also reporting on it. You will have sold as agent for the company.

The risk of compromise comes from pre-appointment advice to the director, who is involved with the new company as well as the bust company.

Pre-liquidation sale…

In a pre-liquidation sale, you’ll have to report on the sale to the creditors. But, you will not be a party to the sales and so need to be objective and impartial when reviewing it and reporting on it.

Therefore, the risk of compromise comes from the pre-appointment advice and your involvement in developing the strategy.

Mitigating the ethical issues

Clearly identify who you are advising pre-appointment. Is it the company, through its directors? Or, the directors personally – as directors of the bust company, or the new company? Directors don’t always see the nuances of the situation.

You should be steering both the buyer and perhaps the directors towards independent advice.

Consider getting separate valuations for yourself as liquidator? Consider whether your valuation should be pre or post-appointment?

Commercial issues

- The timing of the transaction

- The funding of the transaction

- The issues around trading

- Business resilience (the effect that all this will have on the survive-ability of the business)

- Employees and their rights through TUPE

Timing

- The speed of appointment is important.

- The completion date for a pre-pack administration and pre-pack liquidation sale are likely similar.

- However, a post-liquidation sale is probably going to be slower.

- Is there a QFC? This will slow down the appointment.

You can conclude the sale before formal notices go out to creditors (which will minimise the shock), if it’s being dealt with as:

- A pre-pack administration; or

- A pre-liquidation sale (make sure that the new company has made an informed decision on the implications of s216)

Funding & Trading

- Should the business still be trading?

- How is it being funded in the pre-appointment stage?

- How are creditors being protected?

Transactional costs, including the costs of:

- The evaluator (if there needs to be one)

- Valuations

- Independent advice for the new company

- Independent advice for the directors

We’ve written a guide to instructing an evaluator for administration phoenix pre-packs, which can be read here.

TUPE

What are the plans for restructuring the workforce?

TUPE is less of a risk for the buyer if:

- The bust company deals with the necessary redundancies pre-liquidation

- The liquidator sells the assets following appointment

Otherwise:

- Redundancies can trigger claims for unfair dismissal

- Responsibility may pass to the new company

- The extra risk may affect the price

Comments