On Monday 12th July Insolvency Guru Malcolm Niekirk held one of his popular Coffee Break Briefing Webinars. In the free webinar, Malcolm looked at R3 Standard Form CVA Proposals and CVA Standard Conditions.

This is the summary article following the briefing. If you'd prefer to watch the presentation rather than read this article, you can watch below:

To keep up to date with Insolvency Law and to be informed of upcoming Coffee Break Briefings, please sign up to our insolvency newsletter here.

Quick Links

This is a long and comprehensive article, so we've provided some quick links to help you navigate quickly:

- What is the R3 standard CVA?

- What is the template for?

- Is a CVA the solution?

- What cases might it fit?

- How well does it work?

- Will/should you use it?

What is the R3 standard CVA and what was it designed for?

It is a collection of template documents made to make it easier to set up a CVA, in the cases for which those documents are suitable.

With the R3 standard template, there are no special rules or anything that makes it different from any other CVA and there are no special conditions for using it.

Essentially, what it boils down to is that somebody else has done a lot of drafting; so you don’t need to do as much!

It is not suitable for all cases and was drafted with a particular situation in mind, which is:

- An owner managed business (SME)

- Hit by temporary external factors

- Has a profitable history behind it

- And only needs time to pay back its debts in full

What is the R3 standard CVA template used for?

If accepted, it sets up a moratorium; a breathing space for a phased re-establishment of the business.

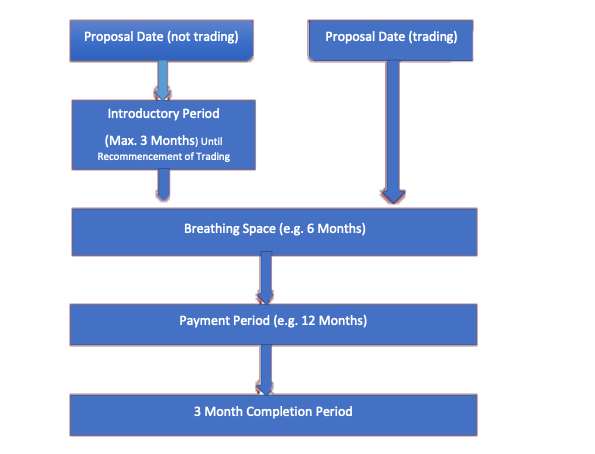

Phase 0 (optional) – re-opening - gives the business a short time to re-open | (Typically 3 months) |

Phase 1 - Breathing space – Business still trades, but it has a complete moratorium on historic debts | (Typically 6 months) |

Phase 2 - The settlement period – by now the business should be re-established and paying its creditors through the CVA | (Typically 12 months) |

Phase 3 - Dealing with the completion of the CVA and closure once the supervisor has enough funds to pay the creditor in full | (Typically 3 months) |

Approval to closure: | (Typically 24 months) |

What routes are there into the CVA?

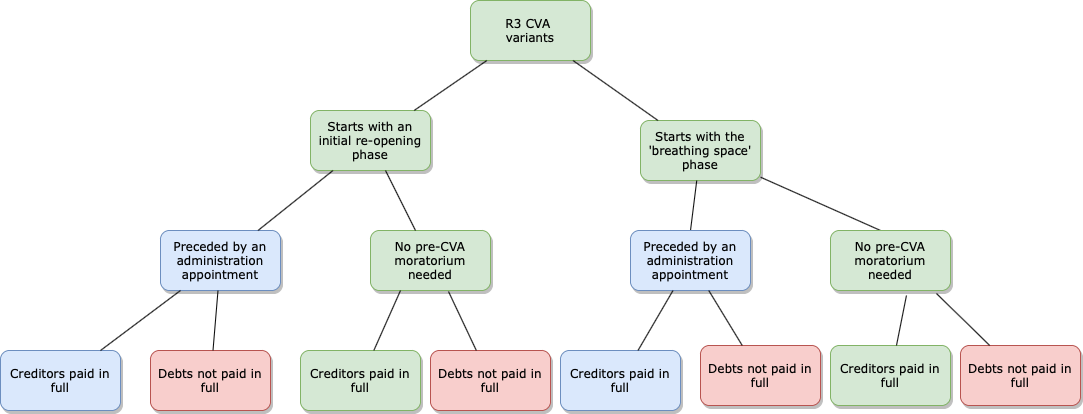

Broadly speaking, there are two alternative routes into the CVA depending on whether the business is actually trading or whether it needs an introductory period in which to reopen.

There are some official and semi-official variations of this, in addition to the two possible opening phases. There are variations that deal with:

- the business needing creditor protection in the form of an administration prior to the beginning of the CVA.

- the business asking creditors to write off part of the debt owing to them.

Is a CVA the solution?

A CVA is a turnaround process – IPs need to think about how the business is going to operate when it is in a CVA

If you’re going to be the supervisor of a CVA and are depending on the continuing success of that business to generate the income from which to pay the creditors, then you owe an additional responsibility to understand what is changing about the business and how it is going to succeed.

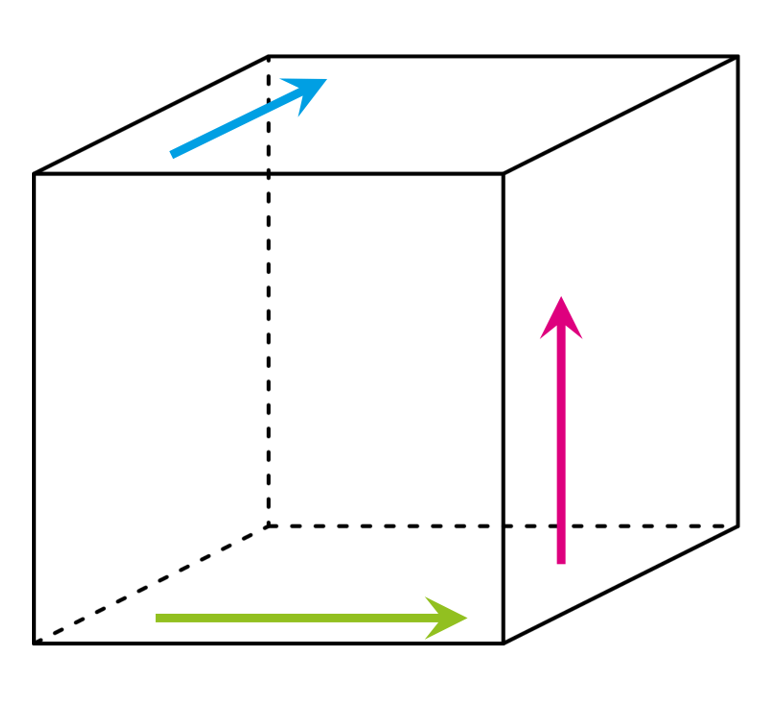

Can the business move to a new place in three dimensions?

- Finance

- Management

- Business

The three dimensions to a turnaround

Financial:

You’ll be looking at the working capital that’s available to the company – whether it’s enough – and whether the creditor indulgence that’s being offered through the CVA is enough.

Management:

Their ability, their credibility and what changes may need to be made to make the business succeed.

The business:

It’s immediate plans, what the medium plan and what the strategic objectives are.

Consider the creditors…

Voting

- Unsecured creditors – 75% majority needed.

- Unsecured creditors – Connected creditors cannot impose their will if most unconnected creditors who vote are in opposition.

Dividend offer

- Unsecured creditors – remember Crown preference must be paid 100p/£.

Viability

- Unsecured creditors – will key suppliers still support (on workable terms)?

- Secured creditors – will they allow the company to remain in possession?

Creditor pressure

And, does the company need an immediate moratorium (administration)?

Other considerations…

Suppose the turnaround could work and the creditors will support the proposal in voting and implementation. There are other things that need to be considered:

- Reputational issues (how damaged will the goodwill be; will customers remain loyal)?

- Corporate complexity (potential knock on effects on other companies in a group)?

- Might a pre-pack be easier? (Or a ‘light touch’ administration?)

(Remember, of course, that you will need creditor approval, or an Evaluator’s report, for a connected-party pre-pack. Get in touch if you need an Evaluator’s report; we are set up for preparing those.)

What cases are right for an R3 CVA?

The terms were designed for:

- Smaller businesses (SMEs).

- With a profitable history.

- That need (only?) time to pay creditors in full.

When the templates were written just over a year ago, the anticipation was that circumstances would be rather different. The template was launched in October 2020, but there are many businesses that have come out of lockdown since then.

There are however many businesses that are still adversely affected.

What issues were not anticipated when the terms were designed?

- Significant accrued debt to creditors:

- eg, landlords.

- Disputes about informal moratorium terms.

- Additional bank debt, eg.

- Bounce Back Loan Scheme (BBLS),

- Coronavirus Business Interruption Loan Scheme (CBILS),

- Coronavirus Large Business Interruption Loan Scheme (CLBILS)

- Recovery Loan Scheme (RLS)

- Pay as you Grow)

- Misappropriation of emergency funding.

What’s in the template and how well does it work?

There are two main documents in it:

A standard proposal – the outline of the basic offer put to credits

Standard conditions – the legal terms and conditions that will apply to the CVA (if approved)

Standard proposal (structure)

- Opens with particulars – a summary table of commercial terms

- Body - explains the timetable and effect

- Appendices:

- R3 COVID-19 Standard Conditions

- Amendments to the standard conditions

- Statutory information

- Financial information

- Estimated outcome

- Assets & liabilities; guarantees

- The story of the business

- Remuneration and expenses

Standard proposal (text)

- Creditors’ dividends funded from monthly instalments (need not be equal).

- All assets are excluded.

- Deferred debts (to connected parties) are paid last.

- Shareholders get no dividends.

- Directors’ salary is not to increase.

- Supervisor can veto:

- Unusual new liabilities;

- New borrowing.

- Failure to pay new debts when due is a breach of the VA.

In addition, the text within the standard proposal also stipulates that:

- The company is intended to trade normally.

- The supervisor has a discretion to extend the phases.

- The supervisor has a discretion to suspend the payment of instalments if there is a new lock-down period.

The Standard Conditions

The standard conditions are closely modelled on the R3 standard conditions for IVAs. There is a mark-up available which shows the difference between the IVA and CVA standard terms, which can be found here.

How useful are the CVA standard terms?

- They are probably a good starting point for small business CVAs

- The structure of the standard proposal is convenient as well

- Particularly the opening ‘particulars’

- Complex CVAs – particularly retail restructuring ones – will be difficult to build on this format

Should you use the template?

- It’s a sensible – and conventional – CVA model.

- It’s designed for quite specific and narrow circumstances.

- But it has potential to be adapted to fit others.

- It has the same constraints and limits as CVAs have always had.

- The world may have moved on since the template was developed.

- Coming out of lock-down may be more complex – and uncertain – than envisaged 12 months ago.

- Other options may be better in any given case, eg:

- Pre-pack administration.

- Liquidation

Here are some useful links:

- R3 standard form template

- R3 standard form notes

- R3 Standard conditions

- The R3 standard form Covid-19 CVA proposal

- The difference between the IVA and CVA terms

Insolvency Law: Coffee Break Briefings

If you would like to stay up to date with the latest developments in insolvency law, you can sign up to our mailing list. You will also receive invitations to all webinars, briefings and events.

Insolvency & Restructuring Solicitors near London, in Hampshire & Dorset, near Southampton and in Bournemouth, Poole, Christchurch and The New Forest

We hope you found the briefing useful. If you are an insolvency practitioner who would like to discuss the content of this article, please do not hesitate to get in touch.

Comments