s110 MVLs

Section 110 reconstructions: A complicated corner of solvent liquidations

Frettens’ resident Insolvency Guru, Malcolm Niekirk, delivered one of his popular monthly coffee break briefings to insolvency professionals on Monday 10th May.

He spoke about section 110 reconstructions, what they are used for, what a typical transaction looks like and, each party's role and timescales, as well as pricing the work.

Below, we have provided a summary of what was included. You can also download the slides and a recording of the presentation.

This article is pretty comprehensive, so you can skip to the part that is most relevant to you by following the links below:

- What is section 110?

- What the law says

- What is section 110 used for?

- A typical s110 transaction

- The professionals involved in a s110 transaction

What is section 110

Section 110 of the Insolvency Act, 1986, allows for a liquidator to accept shares (issued by a buyer) in consideration for assets transferred from a solvent company. The liquidator passes those shares to the shareholders. By that means, they become the owners of the company that now owns the business.

What is section 110 used for?

Most commonly, s110 is used to split a company that owns two businesses into two companies, each owning one business. This might happen if a family business has been passed down the generations and evolved into two distinct divisions.

A typical s110 transaction

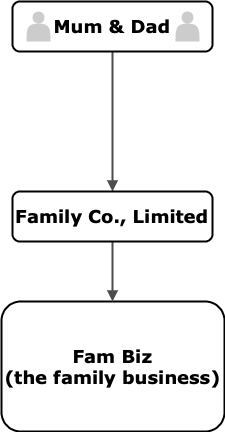

This might be what the business looked like a couple of decades ago.

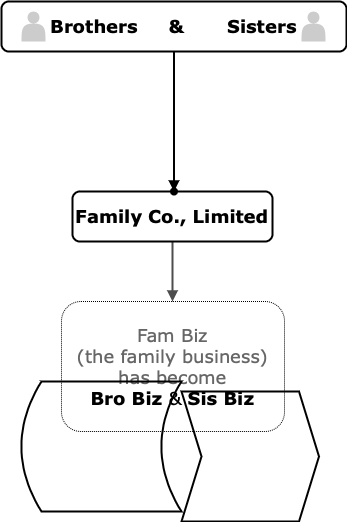

This might be what it looks like now.

The founders are enjoying their retirement. The business is in safe hands, and flourishing well, in the hands of the next generation. But it looks quite different from what it was originally. The two new elements no longer make business sense in the same company.

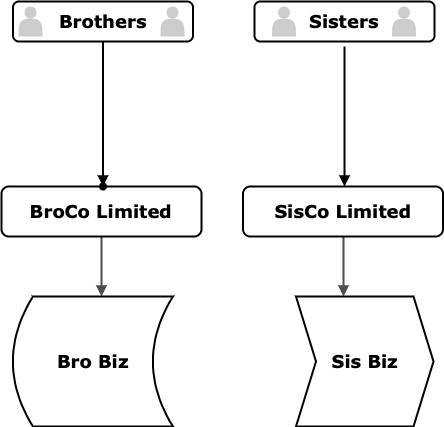

By using a s110 reconstruction, the businesses can be separated, and each put into its own company. Each company is owned by the family members most interested in that sector of the business. This is a tax efficient way of doing it, and usually will not trigger tax liabilities, despite the changes of ownership of companies and businesses.

What the law says about s110

Conditions where a s110 reconstruction can be used

For reference, I will refer to the company at the centre of this transaction as 'NotBustCo' throughout this piece.

The first condition is that there has to be a solvent voluntary liquidation.

The second condition is that you need a transfer of business property.

The third condition is that the purchaser has to be a company, or an LLP. It doesn't have to be a Companies Act company. It can't be a single individual, or a partnership.

So, when can s110 be used?

In a voluntary liquidation (MVL) of NotBustCo when there is a transfer of business property to a buyer who is a company or LLP (let’s call the buyer NewCo).

What can s110 authorise a liquidator to do?

An s110 scheme can authorise a liquidator to:

- take shares (as a consideration for the transfer) in NewCo; and

- distribute them to NotBustCo's shareholders

NotBustCo must pass a special resolution to authorise it.

- The resolution can authorise other types of interest – other than shares - from NewCo as the price it pays.

- Different authority is needed if it is a CVL rather than a MVL (but a s110 reconstruction in a CVL is very rare).

Legal Risks with s110

There are two legal risks that you need to be aware of in a Section 110 reconstruction.

They are:

- The risk of insolvency.

- The risk of a dissenting minority shareholder.

Risk of insolvency

This is triggered if a petition results in a winding up order within 12 months. If that happens, it invalidates the special resolution.

If the special resolution is invalidated, the liquidator’s authority for the transaction is also invalidated. That puts the liquidator at risk of misfeasance because they have, as liquidator done something for which they have no legal authority, they have exceeded their powers.

Whilst this is very unlikely to happen, if it does happen, the consequences are costly. There are ways to mitigate the risk.

Mitigating risk of insolvency

The usual way of mitigating it is not an obvious one. But in most Section 110 schemes, this is one of the reasons why the company that is wound up is not the original company.

In a Section 110 scheme a new company is normally created specifically for the transaction. It is usually superimposed as a new holding company and then liquidated within five minutes of it becoming the holding company.

It is a company that has a short, but beautiful life. Because it has never traded, it has no liabilities. That means that the chances of anybody, having a of claim that could result in a winding up through the courts, is extremely remote.

Alternatively, the company could pass the resolution and wait 12 months. This is not a common approach; there is always a risk that the tax rules might not be the same in the next tax year.

The third way which, of course, is always prudent in an MVL, is to make sure that the company involved is very solvent.

The fourth way is to get a decent indemnity (remembering that a loosely worded indemnity might not allow the shareholders to receive their expected stamp duty exemptions on the transfer of shares).

Risk of having a s110 overturned by a dissenting shareholder

Any shareholder can object to the transaction, but not if they voted for it. They have only seven days to object. A shareholder may object, either to block the transaction or to force the company to buy their shares.

Mitigating the risk of a dissenting shareholder

To mitigate the risk of having a s110 overturned by a dissenting minority, you can:

- get all shareholders to sign the resolution,

- wait seven days,

- make the minority an offer in advance, or

- get a decent indemnity (but remember the stamp duty risk).

s110 tax benefits

Broadly speaking, the tax benefits of a s110 resolution are as follows:

- Benefits that shareholders receive are taxed as capital, not income.

- NewCo is treated as acquiring assets on a ‘no loss, no gain’ basis.

- Shareholders’ shares in NewCo are treated as replacing their shares in NotBustCo.

- ‘Degrouping’ tax charges are normally avoided.

- Stamp duty on share transfers (normally 0.5%) is usually exempted (indemnities may put that at risk).

- ‘Acquisition relief’ normally mitigates SDLT to 0.5% (in business division s110 reconstructions; others might be fully exempt).

It is always important to make sure that a tax accountant is getting advance clearance from HMRC.

The professionals involved in a s110 transaction

In a typical s110 transaction the roles of professionals involved will be as follows:

NotBustCo’s directors – they will be [almost] everybody’s client.

NotBustCo’s accountant – they are often the project manager.

Tax accountant – devises scheme and get clearance.

Liquidator – follows cleared scheme to:

- Liquidate a transaction newco; and

- Distribute properties and shares in specie.

NotBustCo’s solicitor – implements property transfers (and corporate transactions).

Liquidator’s solicitor – makes sure the liquidations, distributions, property transfers and corporate transactions follow the cleared scheme, s110, etc.

Timetables for section 110 transactions

In the presentation Malcolm talks about the factors that affect the timetable for the transaction. They include:

- The need to allow time to get tax clearance.

- There are often key dates in the tax calendar for the company or its shareholders.

- The plan needs to allow time for:

- Analysing the clearance, and working out the detailed plan to implement it.

- Preparing the documents, for the liquidation, the company formations, the share transfers, and the property transfers.

- Dealing with the risk of claims by creditors.

- Putting the company into liquidation and appointing the liquidator (with all appropriate authorisations).

- Dealing with the risk of objections from dissenting minority shareholders.

- Transferring the shares and the properties.

In a well-planned s110 reconstruction, the project team of professionals will be assembled before the company applies for tax clearance, and the liquidator and their solicitor will be instructed to review and comment on the tax clearance before it is submitted to HMRC.

Comments