On Monday 13th September, Insolvency Guru Malcolm Niekirk held one of his popular Coffee Break Briefings.

In the free webinar, Malcolm gave his views on the recent controversy about the ethics of transferring cash-at-bank before a liquidation starts. (For convenience, this is called ‘FAQ 10’.)

He discussed how the controversy started, what the issues are with it and why he suggests that recent informal guidance can be ignored.

This is the summary from the presentation. If you’d like to watch it back, you can do so below. If not, read on for a summary.

To keep up to date with Insolvency Law and to be informed of upcoming Coffee Break Briefings, please sign up to our insolvency newsletter here.

Quick Links

- How did 'FAQ 10' come about?

- What is FAQ 10?

- What is the revised FAQ 10 guidance?

- Why you can ignore FAQ 10

- FAQ 10 and the law

- The practical consequences of FAQ 10

- How to comply with the revised FAQ 10

- A Q&A

How did FAQ 10 come about?

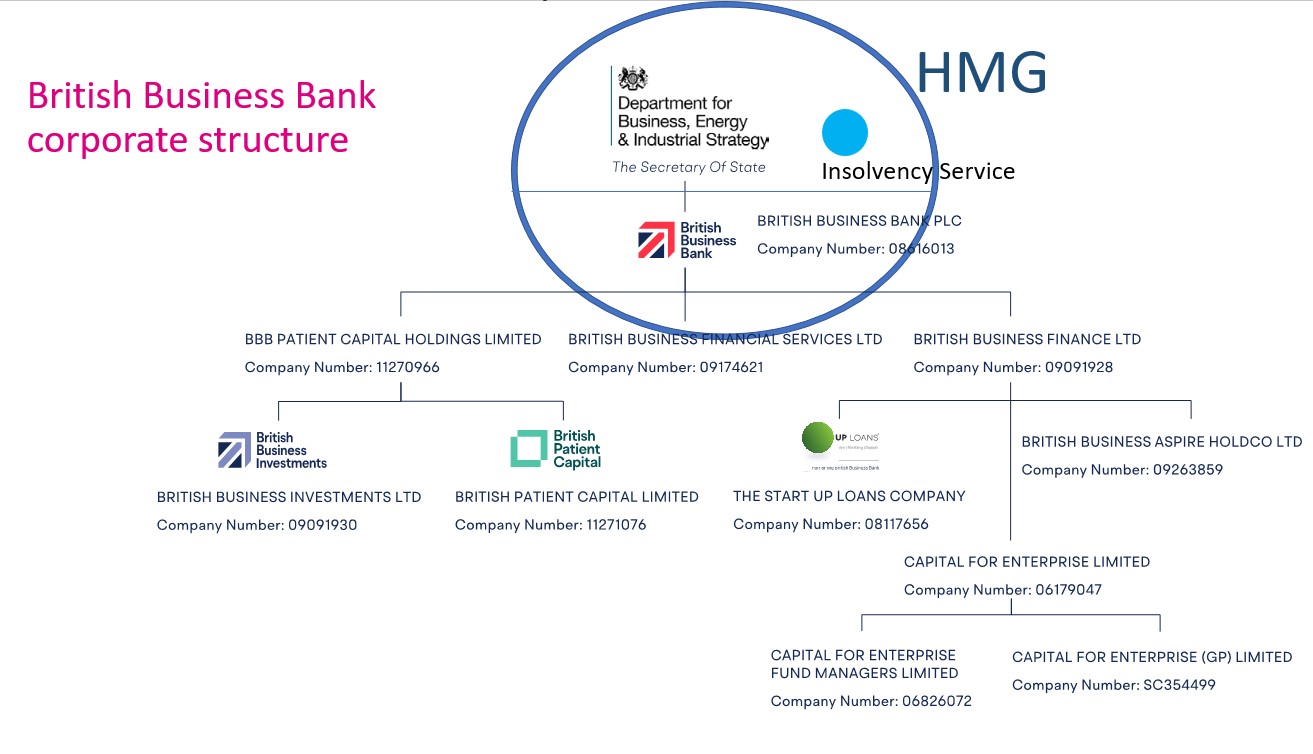

In a recent R3 seminar, a well-informed panel of speakers looked at ‘bounce back loans’.

The speakers included representatives from

• The Insolvency Service

• The Department for Business, Energy & Industrial Strategy (DBEIS) (Secretary of State)

• The British Business Bank (owned by the SoS for DBEIS)

• UK Finance (which represents the banking and finance industry)

The British Business Bank issued the government guarantees for ‘bounce back loans’. It’s a wholly owned subsidiary of DBEIS.

Clearly the seminar* was dominated by Government speakers.

*the views expressed in the seminar were those of the speakers, not R3 (the Association of Business Recovery Professionals).

What is ‘FAQ 10’?

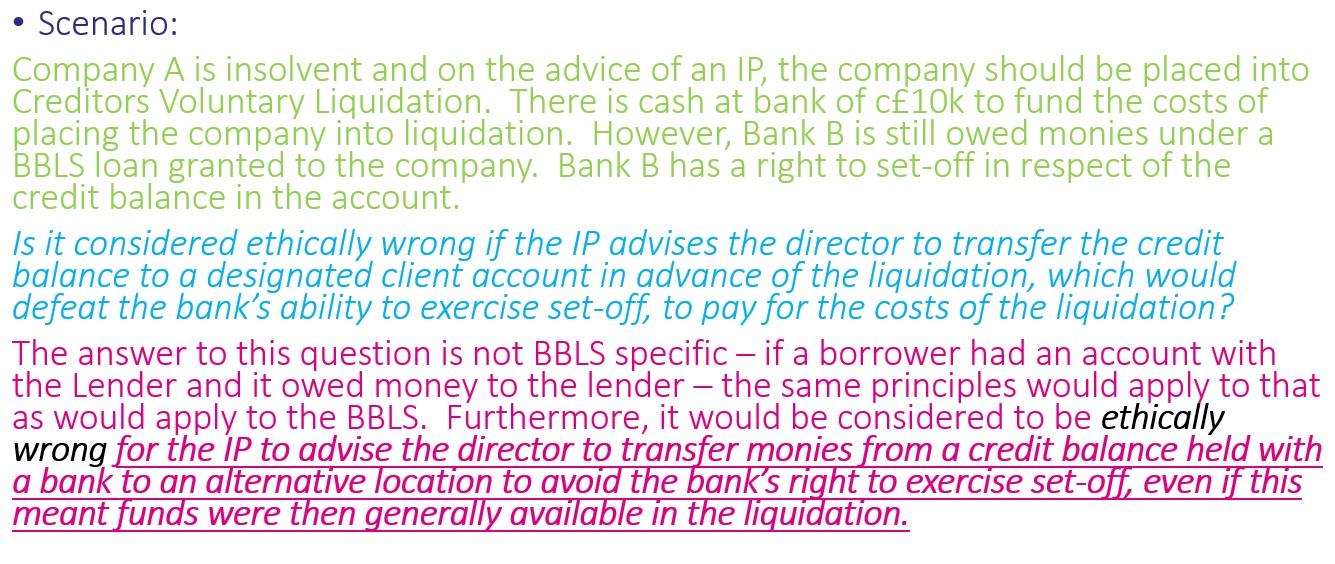

Following the presentation, the speakers issued some written guidance in the form of Frequently Asked Questions (FAQs).

One that caused a lot of interest was FAQ 10, as it seemed to suggest that it would be ‘ethically wrong’ for Insolvency Practitioners (IPs) to advise directors to transfer the cash-at-bank into the IPs own client account pre-liquidation.

But, of course this is long-established custom and practice.

This is the full text of FAQ 10 (with our added emphasis):

On 9 September 2010 this guidance was withdrawn and replaced.

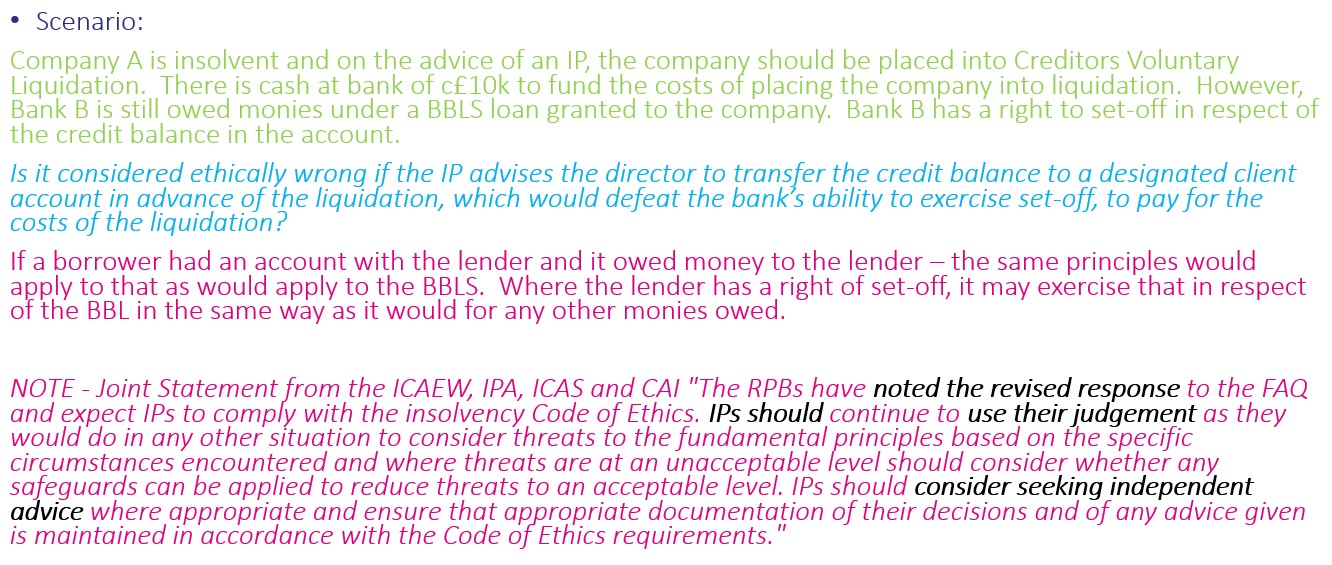

What is the revised FAQ 10 guidance?

The new guidance includes a statement from the RPBs. In summary:

- Banks have the same right of set off for BBLs as they have for any other debt

- IPs must ‘comply with the Code of Ethics’, ‘use their judgement’ and ‘consider seeking independent advice’

- Note the ‘revised response’.

This is the full text of the revised FAQ 10 (with our added emphasis):

Why you can ignore FAQ 10

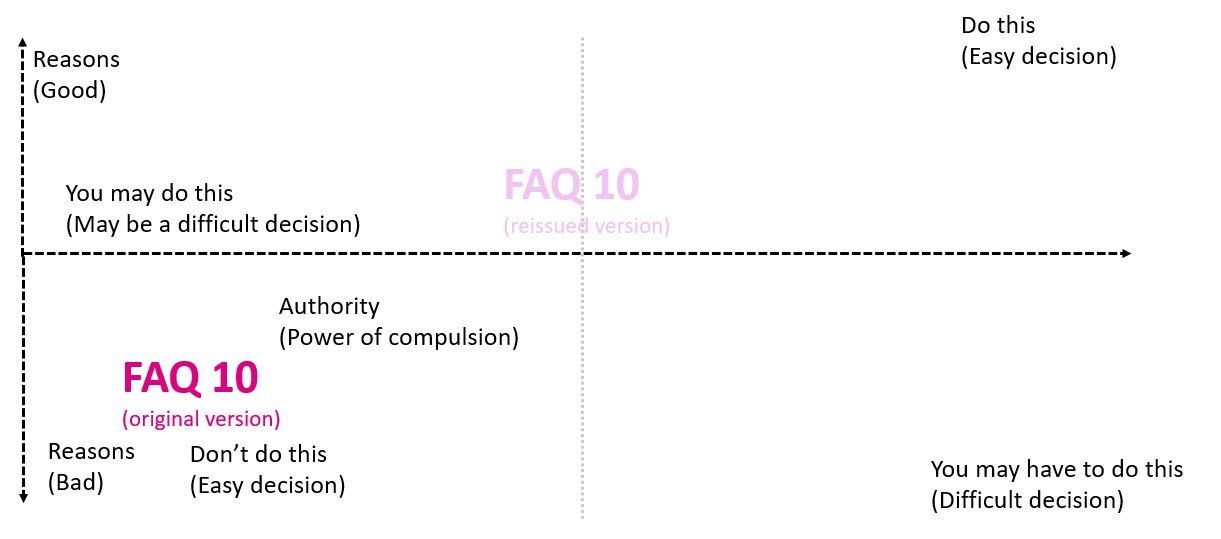

Below I’m going to look at how ‘authoritative’ FAQ 10 is and was.

What I mean by that is that some instructions are no more than suggestions.

Other instructions are intended to be mandatory; and carry consequences for non-compliance. Some carry more weight than others, and there is a line – often indistinct and imprecise – between those which are mandatory and those which are not.

Also, there are always reasons for instructions. Sometimes they are good reasons and sometimes they are bad reasons.

The decision, whether to follow a particular instruction, can be assessed by reference to how binding that instruction is, and how good the reasons are for following it.

I’ve marked where I think both the original and revised versions of FAQ 10 fall within this matrix:

(The revised version of FAQ 10 is very much lighter and less prescriptive than the original, but – as a rare joint statement from the RPBs – more authoritative.)

Is FAQ 10 compulsory?

For the original FAQ 10, there was little authority or legal power of compulsion behind it; despite the well-informed speakers.

The revised FAQ 10 has legally binding power behind it because it’s an instruction to follow the Insolvency Guide of Ethics (which we’re obliged to do anyway). The reasons for following the guide of ethics are generally good reasons.

But the guidance it contains has become much diluted and is only a faint version of what it originally was. The new FAQ 10 is something that you should follow, but it is so vague and non-specific that it shouldn’t cause much of a problem in terms of compliance.

As a practical suggestion, I’ve provided the text of a file note that you could adopt to ensure you are documenting your compliance with FAQ 10 in its revised form. Here’s the link.

Can the Secretary of State create ethical rules? How?

The Secretary of State does have the power to make ethical rules. But they have to follow a set procedure. They cannot rule by decree.

Suppose the Secretary of State wants to make a new ethical rule. To do so they must:

- Draft a proposal.

- Consult the Recognised Professional Bodies (RPBs).

- Explain why the proposal is needed.

- Give the RPBs time to:

- Consider it; and

- Make representations.

That procedure is set by s391E Insolvency Act 1986.

The RPBs would consult IPs as a matter of good practice and to avoid the risk of challenge by judicial review.

Why else can you ignore FAQ 10?

FAQ 10 was issued:

- Outside the proper statutory procedure.

- Without proper reasons given to justify it.

- Without prior consultations.

- In circumstances which suggest a possibility of exposure to conflicts of interest.

FAQ 10 (in its original form) appears:

- To conflict with established law and practice.

- To create a real possibility of consequences that are not in the public interest.

If FAQ 10 was intended to be binding, it seems vulnerable to judicial review. If it wasn’t intended to be binding, it can be ignored.

FAQ 10 in its revised form is the RPBs saying:

- There’s an established, published ethical code of conduct.

- It’s issued, legitimately, by bodies authorised to do so (the RPBs).

- Follow it.

- Record your decision, if you need to think about it.

- Get advice, if it’s difficult.

The RPBs refer to the original FAQ 10 – they probably had to – to give the context for their statement. I think therefore that their statement needs to be read as referring to the original FAQ 10, and a substitute for the guidance in it.

Now there is a public debate about the ethics of instructing directors to transfer cash-at-bank to insolvency practitioners’ client accounts, pre-appointment. It follows that insolvency practitioners should consider, case by case, the ethics of giving that instruction when they do so.

The relationship between the original FAQ 10 and the law

Why you can ignore FAQ 10 – the legal reasons

FAQ 10 conflicts with several fundamental principles:

- Pari passu rule

- If, ethically, IPs are being told to stand back and encourage one of the unsecured creditors to steal a march over the other unsecured creditors, this conflicts with the pari passu rule. The rule states that unsecured creditors are to share equally!

- Liquidation expenses rule

- Liquidation expenses have statutory priority, they are paid first from the funds available.

- Liquidation protects the company’s assets

- Taking possession of the cash at bank pre-liquidation freezes it. It ensures that it is safeguarded and available for all creditors.

FAQ 10 is in conflict with the Insolvency Act:

- The law protects a company’s assets through rules against:

- Preferences

- Transactions at an undervalue

- Set off is a lot more complicated than FAQ 10 suggests originally.

- Insolvency set-off applies automatically, only on liquidator’s appointment

- Contractual set-off may also apply, before and after the liquidator’s appointment. It may be wider than the insolvency set-off. It may include:

- The debts of other parties – e.g. under a guarantee of a loan to a separate joint venture company.

- Debts owed to other parties – e.g. a factoring shortfall

- Contingent debts – e.g. credit card charge-backs

- Future debts – e.g. if the bank clears pre-liquidation payments after your appointment

The Insolvency Code of Ethics and FAQ 10

I’ve had a look at the existing Insolvency Code of Ethics and seen nothing in it to support FAQ 10. I’ve also had a look at the SIPs, and SIP 11 seems to be inconsistent with FAQ 10.

SIP 11, §6(b) is particularly relevant. It says that:

‘… estate money [meaning the company’s credit balance] should be held in account(s) that meet the following criteria:

b. the account provider must not be entitled to combine estate money with any other funds or exercise any right to set off or counterclaim against any individual estate in respect of any money owed to it by any other individual estate, or for any other reason;’

SIPs and FAQ 10

SIP 11 strictly only applies from when you are appointed as liquidator, but the general policy behind the SIPs is that they should also apply pre-appointment. It is entirely reasonable for insolvency practitioners to make sure, in advance, that they are in a position to comply with SIP 11 as soon as they are appointed.

In practical terms, to comply with SIP 11 §6(b), you must get the cash at bank transferred pre-liquidation. This is because:

- Pre-liquidation, the bank holds a mandate from the director and must follow the director’s instructions.

- The bank may be contractually entitled to set off, and may choose to exercise its right.

- (On public policy grounds, that right ought to be limited. Removing the balance protects the asset from being seized by one creditor in this way.)

- Post liquidation, the bank will need to verify your authority.

- It may need a new mandate from you.

- That will take time.

- Meanwhile, you are not complying with SIP 11 §6(b).

The practical consequences of FAQ 10

What would happen if you were unable to transfer funds into your client account pre-appointment:

- No funds to pay full legitimate expenses of liquidation.

- Directors can’t get advice (because the funds are not available to pay for it) and, as a result:

- Funds may dissipated to the detriment of creditors.

- Directors may be put at personal risk.

- Unregulated advisors can be expected to step in to advise companies – having secured funding by taking possession of the cash-at-bank – in the ‘twilight zone’ if it becomes harder for them to get advice from insolvency practitioners.

- Directors can’t get advice (because the funds are not available to pay for it) and, as a result:

How to comply with the revised FAQ 10

Despite the revised FAQ 10 being diluted and watered down, you ought to comply with it.

I suggest you might comply by putting a note on the file, about the same time as you send out your engagement letter.

The file note should record that you have:

- Advised the director to transfer cash at bank to our client a/c to protect and preserve it. (Considered SIP 11(§6(b)).)

- Noted that the bank is free to exercise any available rights of set off before that transfer is effected, and may do so.

- Considered the ethical implications of this advice, under the Insolvency Code of Ethics. Reflected on the analysis in Frettens’ briefing (13 September 2021) and considered that no further discussions needed on this point, in these circumstances.

I’ve provided the file note here.

To conclude, you can ignore FAQ 10 because:

- It was issued without any legally binding authority

- It conflicts with the existing law and professional guidance

- There could be adverse practical consequences for creditors and the proper administration of the insolvency process.

A Q&A

In the briefing, I was posed some questions from the webinar attendees. Here are my answers.

Would there be any change in your position on FAQ 10 if the bank has a floating charge over the company’s assets?

If there was a fixed charge on the bank account, then the bank account would necessarily already be frozen and could only be operated with the consent of the bank.

I would say that if there was a floating charge, there is no difference. If the floating charge has not crystalised into a fixed charge, then the bank has not taken control of the cash-at-bank so it is still free for the director to use in accordance with the established custom and legal practice.

What would be the position if a fee was taken from the bank account and then it was found the bank was in overdraft?

There would likely be a problem as effectively the director would have taken money from a creditor, incurring a debt specifically to pay the liquidation expenses. There is a possibility of fraudulent trading as far as the director is concerned.

That may not be a problem if the director had given a personal guarantee to the overdraft because the director would effectively have to pay that themselves and the bank will not suffer the loss.

What if the bank account is frozen due to other circumstances before appointment? What are my options?

In this case, there is no-one to instruct the transfer of the funds. To solve this, you could:

- Write to the bank and state that you are about to be appointed, and that any payments out are at risk of being preferences

- Get a creditor to issue and serve a winding up petition. Then, once the bank has notice they would have to freeze the bank. They would be entitled to apply insolvency set off at that.

There’s not really an easy answer to this!

Related Article: Remuneration in administrations

Insolvency Law: Coffee Break Briefings

If you would like to stay up to date with the latest developments in insolvency law, you can sign up to our mailing list. You will also receive invitations to all webinars, briefings and events. My next Coffee Break Briefing will take place on October13th, where I will be looking at Zombie Litigation.

Insolvency & Restructuring Solicitors near London, in Hampshire & Dorset, near Southampton and in Bournemouth, Poole, Christchurch and The New Forest

We hope you found the briefing useful. If you are an insolvency practitioner who would like to discuss the content of this article, please do not hesitate to get in touch.

Comments